What is a leasehold?

Leaseholds offers a unique opportunity for homebuyers to enjoy the benefits of owning a home. With Cedar, you can co-own the land, reducing your monthly costs and making home ownership more affordable.

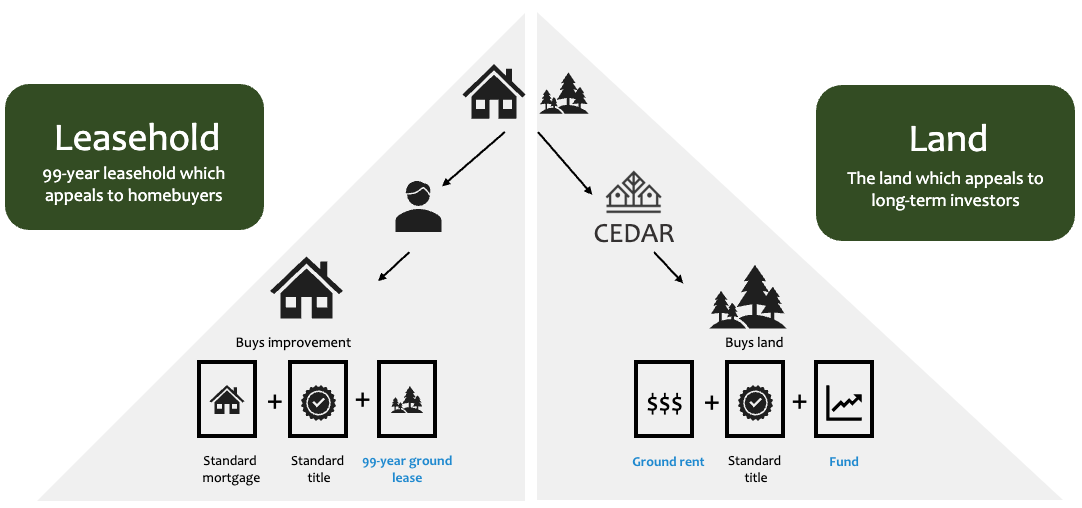

You buy the house, but lease the land

We cover 20-50% of the total purchase price by buying the land, while you own the home with a traditional mortgage.

You lease the land from us for 99 years, paying a manageable annual ground rent.

This unique approach reduces your upfront costs and makes homeownership more accessible.

Getting a Leasehold Property with Cedar

Homebuying is complicated enough. We make getting your leasehold property simple and straightforward.

Find a home you love

Explore freely knowing that Cedar is here to help with the downpayment and mortgage

Finance with Cedar & Homeward

Start an improved mortgage with your lender

Buy the home from the seller

Cedar buys the land from the seller with cash upfront

Enjoy it as long as you want

Pay ground rent to Cedar at a much lower rate than a mortgage for the land would cost

Enjoy full use of the house, the land—everything

Sell it (or don't)

Sell the home or the whole property whenever you want

Purchase the land from Cedar whenever you want

FAQs

Find answers to commonly asked questions about leasehold properties and Cedar's approach.

Discover the Leasehold Advantage

Learn how Cedar's leasehold program can make home ownership more affordable.